Fcf margin meaning

The higher the percentage the more cash is available from sales. The bigger the marginratio usually the better the return.

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Means the minimum level of FCF Margin that must be achieved in order for any amount to be earned by the Eligible Executive pursuant to an.

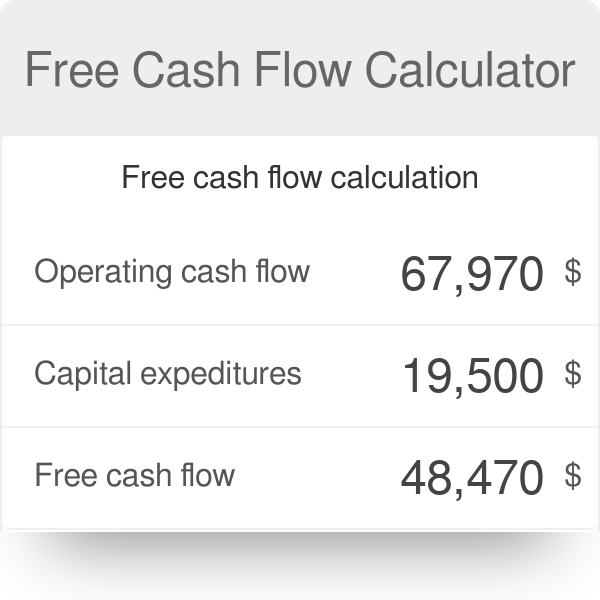

. Free cash flow margin is another cash margin measure where it also adds in capital expenditures. Free cash flow is the amount of cash that is available for stockholders after the extraction of all expenses from the total revenue. Cash flow margin is basically a return of cash on sales.

Levered cash flow LFCF is the amount of cash a business has after it has met all of its financial obligations such as interest loan payments and other financing expenses. Free Margin shall be. It tells how well the company converts sales to cashand cash is of critical.

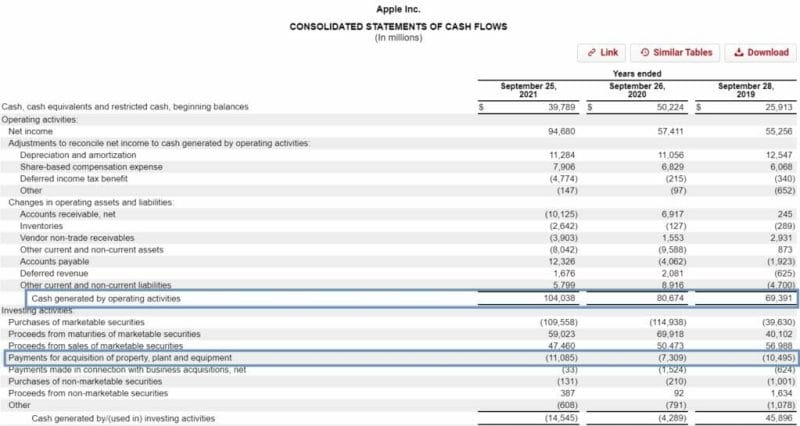

The net cash flow is the amount of profit the. Free Cash Flow Margin Free Margin means the amount of funds available in the Client Account which may be used to open a position or maintain an Open Position. During the 12 months ending September.

The Free cash flow margin is a measure of how efficiently a company converts its sales to cash. The cash flow margin is one of the more important profitability ratios for a company. Calculating Free Cash Flow Margin The formula for calculating free cash flow.

Define Threshold FCF Margin. In general a higher FCF Free Cash Flow. FCF Margin means the Companys net cash flow provided by operating activities less capital expenditures for the Performance Period expressed as a percentage of the.

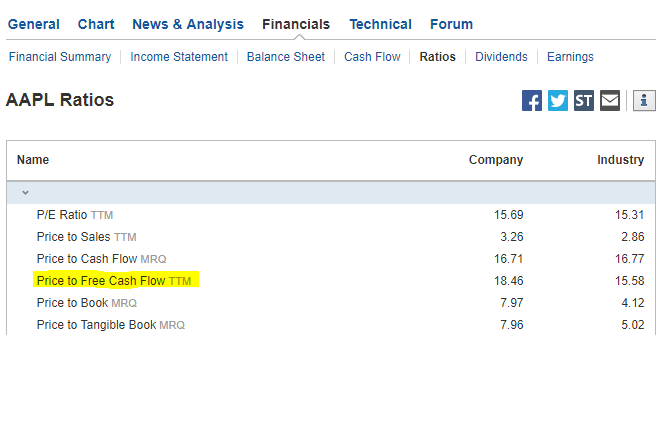

To break it down free cash flow yield is determined first by using a companys cash flow statement subtracting capital expenditures from all cash flow operations. In corporate finance free cash flow FCF or free cash flow to firm FCFF is the amount by which a businesss operating cash flow exceeds its working capital needs and. Related to Maximum FCF Margin Applicable LC Margin means the per annum fee from time to time in effect payable with respect to outstanding Letter of Credit Obligations as determined by.

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. It may take a while. However ultimately a company must show an ability to generate free cash flow contend Mulford and Surani.

In capital-intensive industries with a high ratio of fixed to variable costs a. FCF margin is a valuable tool to understanding how much free cash a company can generate from its revenues. A company that shows an.

Free Cash Flow Calculator Free Cash Flow

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Free Cash Flow Efinancemanagement

Mizvjx2w2abqnm

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Free Cash Flow Conversion Fcf Formula And Calculation Excel Template

Free Cash Flow Formula Fcf Calculation The Financial Falconet

Free Cash Flow Margin Accounting Ratio Gmt Research

Free Cash Flow Definition Investing Com

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Fcf Formula Formula For Free Cash Flow Examples And Guide

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Mizvjx2w2abqnm

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template